Bank anytime, anywhere

Instant Balance

Staying on top of your accounts has never been easier.

Instant Balance

When it comes to managing money for tuition, books or back-to-school shopping, feeling empowered is key. Instant Balance within the Ixonia Bank Mobile Banking app puts you in control. Quickly and easily check up to six account balances at the touch of a button, all without logging in. Both parents and students can feel financially confident to view account balances and transfer money in an instant.

Instant Balance gives you secure access to your account(s) balance without logging into the mobile app. This gives you access to what you need, quickly. Whether you’re ready to make a purchase, paying bills or keeping track of your account, Instant Balance makes it easy.

Getting started is easy. Simply follow these instructions to enable Instant Balance:

- Update your Ixonia Bank Mobile Banking App to the latest version

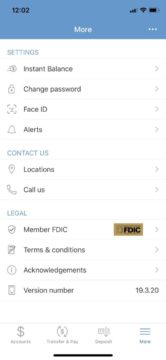

- Log into Mobile Banking app, and select “More” from the bottom menu

- Select “Instant Balance” in Settings

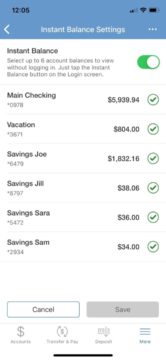

- Slide the “Instant Balance” button to green

- Choose the account balance(s) you want to view (you can choose up to six)

- Tap “Save” to update your settings

To view your balances:

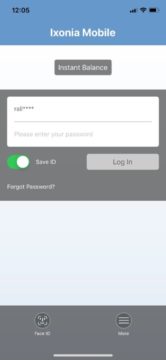

- After setup, view your balances by tapping on the Instant Balance icon on the login screen.

Make sure you have ‘Save ID’ on. The Instant Balance icon will thereafter appear at the top of the login screen. You can also always access it in the More section once you are logged on.

For your convenience, you can follow the below screenshots for reference.

Online Banking FAQs

How does Mobile Deposit work?

Log on to your Ixonia Bank Mobile app then follow these simple steps:

- Endorse the back of the check and write “For Mobile Deposit Only, Ixonia Bank account #_________.”

- Select "Deposit" from the menu bar. Select "Deposit A Check."

- Select the account where you want to deposit your check and enter the check amount.

- Select "Take Photos." Ixonia Bank will need access to your camera.

- Take a picture of the front and back of your endorsed check with your mobile device. For photos that work best, follow these guidelines:

- Position your camera directly over the check (not at an angle).

- Move any objects that show up in the picture away from the check.

- Make sure the check is visible, contains all 4 corners, is well lit, and in focus

- Select "Use" or "Retake" for both sides.

- You are given the option to "Edit" or "Make Deposit."

- Once you click "Make Deposit," you will receive a confirmation on your phone that your deposit is being processed.

- Securely store your check for at least thirty (30) days, and then destroy after the retention period. See the Check Retention and Check Destruction Guidelines.

Is Mobile Banking secure?

Yes. Mobile Banking employs industry-best practices with regards to security. It has been assessed against industry security criteria by a number of independent system security experts.